What are non-Medicare charges?

Simply put, these are costs associated with healthcare services that Medicare doesn’t cover fully. This can include:

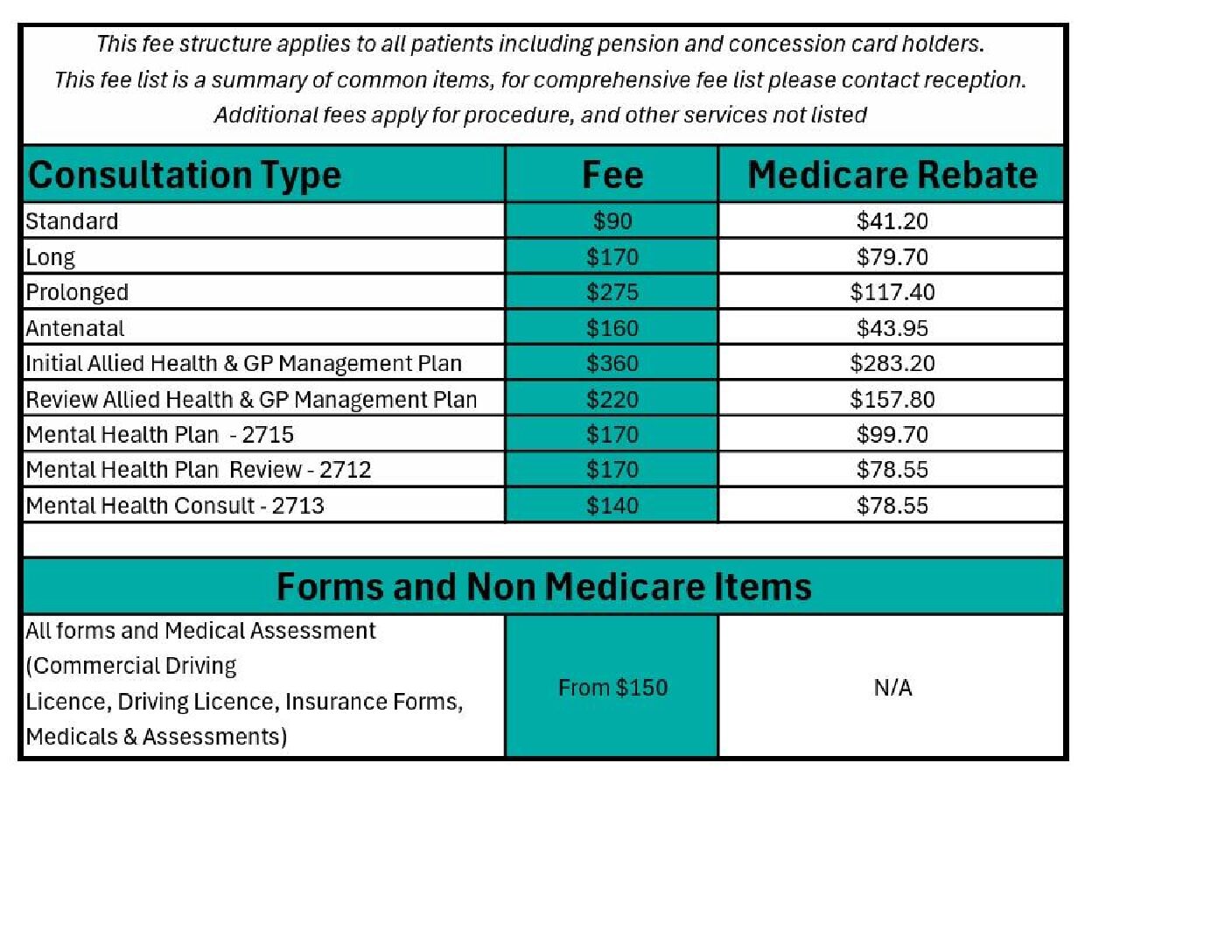

- Gap fees: The difference between what a doctor, specialist, or other healthcare provider charges and what Medicare reimburses them.

- Out-of-pocket expenses: Fees for specific services not covered by Medicare, like some dental procedures, physiotherapy, or cosmetic surgery.

- Hospital extras: Costs for private rooms, additional consultations, or non-medically necessary services during a hospital stay.

- Ambulance fees: Depending on your location and circumstances, some ambulance trips may incur fees.

Why do these charges exist?

Medicare covers a vast range of essential healthcare services, but it’s not limitless. The government sets certain funding levels, and sometimes the cost of providing care exceeds those levels. Additionally, specialists and providers may choose to charge more than the Medicare rebate, leading to gap fees.

How can we manage non-Medicare charges?

- Know your Medicare entitlements: Familiarize yourself with what Medicare covers and the out-of-pocket costs associated with different services.

- Ask questions: Don’t hesitate to ask your healthcare provider about potential costs before undergoing any procedures or treatments.

- Shop around: Compare fees between different providers, especially for elective procedures.

- Consider private health insurance: Depending on your needs and budget, private health insurance can help cover some out-of-pocket costs and offer access to additional services.

- Seek financial assistance: Government programs and charities may offer support for those facing healthcare costs they can’t afford.

Remember, you’re not alone in navigating this complex landscape. By understanding non-Medicare charges, asking questions, and exploring options, we can take control of our healthcare and make informed decisions about our well-being.

Additional resources:

- Australian Department of Health: https://www.servicesaustralia.gov.au/medicare

- Private Health Insurance Australia: https://www.privatehealth.gov.au/

- Lifeline: https://www.lifeline.org.au/131114/